Due to technological advances, the field of financial management has experienced significant change, especially in the area of managing international transactions. In this comprehensive Revolut review, there is a strong rival in the financial technology sector that is spearheading this financial innovation.

An in-depth examination of Revolut’s core characteristics, key features, and overall suitability as the best travel finance management solution in 2024 are all covered in this analysis. By amalgamating the conventional services of traditional banking with the contemporary conveniences afforded by cutting-edge technology, Revolut sets out to simplify and optimize financial transactions across global boundaries.

Whether one assumes the guise of a frequent globetrotter, a digital nomad traversing the digital realm, or an individual seeking to streamline their international financial operations, this article offers an all-encompassing exploration of the multifaceted offerings provided by Revolut.

What’s in this article?

What is Revolut?

Leading fintech company Revolut is responsible for revolutionizing digital banking. The company has launched a mobile application that is highly adaptable and transforms the financial management landscape by simplifying and lowering the cost of international money transfers, purchases, and savings. Revolut seamlessly fuses the capabilities inherent to a traditional bank account with the agility characteristic of a technology startup, thereby furnishing users with an extensive array of financial services directly accessible via their smartphones.

From facilitating real-time currency exchange to enabling worldwide spending and international remittances, Revolut is meticulously tailored to cater to the diverse requirements of contemporary global spenders. At the heart of its mission lies a commitment to eradicating financial barriers and simplifying the management of money across international borders to a degree commensurate with local financial operations.

How does Revolut work?

Revolut operates on the principles of modern finance, marrying traditional banking functionality with the dynamism of a contemporary tech platform to create an all-encompassing financial ecosystem accessible through its mobile app. The intricate mechanics of this financial symphony unfold as follows:

Step #1: Account Onboarding:

Initiating the financial journey with Revolut is a streamlined affair. Prospective users traverse a user-friendly process within the app, completing identity and address verification. This digital-centric approach ensures expeditious account setup, enabling users to quickly start handling their money.

Step #2: Funds Infusion:

Once the account is active, users infuse vitality into their Revolut reservoirs through multiple channels. Bank transfers, credit/debit card deposits, or peer-initiated transactions usher in the funds that serve as the bedrock for a plethora of financial transactions conducted within the app.

Step #3: Currency Chameleon:

Revolut, a virtuoso in its own right, orchestrates real-time currency exchange at interbank rates, offering the dexterity to harbor and transmute a medley of currencies within the app’s embrace. This feature becomes a siren song for globetrotters and international shoppers, significantly abating the toll of exchange fees.

Step #4: Global Spending:

Equipped with a Revolut account, users wield both a digital and physical card, wielding them as instruments for global financial symphonies. These cards seamlessly transmute transactions into local currencies, courtesy of the app’s astute algorithms, thereby obviating additional fees.

Step #5: Cross-Border Funds Flow:

Revolut’s harmonious financial tapestry extends its reach to international realms. Users traverse borders with grace, conducting instantaneous transfers to fellow Revolut acolytes or navigating the SWIFT currents to bestow financial blessings upon non-Revolut entities.

Step #6: Financial Fortitude and Insight:

The app takes on the mantle of a financial maestro, offering avant-garde tools for budgeting and financial analysis. Users partake in the art of financial self-mastery by setting monthly budgets, categorizing expenditures, and receiving real-time expenditure enlightenment.

Revolut weaves a tapestry of financial convenience and efficiency, offering a singular platform for a spectrum of fiscal activities. From daily transactions to the orchestration of international financial symphonies, Revolut caters to the needs of those seeking an accessible and cost-effective means to navigate the complex terrain of modern global finance.

Revolut Key Features

Revolut’s extensive feature set, which has been thoughtfully designed to make managing finances across borders simple and efficient, has made it more and more popular among digital nomads and international travelers. Here are some of the pivotal features that firmly distinguish Revolut:

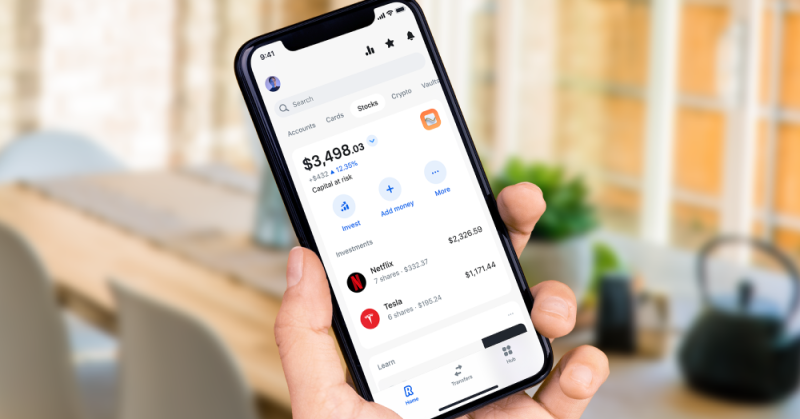

1. Multi-Currency Accounts: Revolut empowers users to hold and exchange funds across more than 30 currencies at the genuine interbank exchange rate, effectively eliminating the burden of conventional bank fees. This facilitates cost-effective international spending and currency conversion.

2. International Travel and ATM Withdrawals: The Revolut card is a great resource for tourists who want to avoid paying hefty fees for international transactions because it provides fee-free travel and ATM withdrawals up to very specific limits.

3. Instant Money Transfers: Revolut makes it easier to send money quickly and securely—often without the heavy fees that come with using traditional bank transfer methods—to another Revolut user or a bank account abroad.

4. Budgeting and Analytics: The app has powerful tools that let users create budget constraints, classify transactions, and keep close tabs on expenses. This helps users manage their money more skillfully by providing them with priceless insights into their financial routines.

5. Cryptocurrency Exchange: Revolut extends the opportunity to purchase, hold, and exchange cryptocurrencies directly through the app. This feature serves as an accessible entry point for users intrigued by the world of digital currencies.

6. Travel Insurance: Users have the option to opt-in for travel insurance coverage via the app, encompassing vital protections such as medical and dental coverage while journeying abroad.

7. Security Features: Revolut places paramount importance on security. It furnishes users with robust security measures, including the capability to lock their cards through the app, personalize PIN codes, and generate disposable virtual cards for online transactions. These measures collectively ensure a high degree of security for financial transactions.

These features, alongside several others, collectively contribute to Revolut’s allure as a comprehensive financial tool tailored to the requirements of users aiming to streamline their financial, spending, and investment activities within an increasingly interconnected and globalized economic landscape.

Revolut Plans

Revolut extends a veritable bouquet of account plans, each thoughtfully crafted to cater to diverse needs and financial spectrums. This spectrum of plans ranges from the untethered freedom of a free standard account to the premium and metal accounts that beckon with their monthly fees, unveiling a treasure trove of additional benefits and features. Here’s a glimpse of this financial panorama:

1. Standard: This entry-level plan, free of charge, grants access to Revolut’s foundational features. It ushers users into a world of multi-currency accounts, global spending prowess, and ATM withdrawals, albeit with nominal fees beyond a specific threshold.

2. Premium: For a monthly fee, Premium Plan patrons are enveloped in a cocoon of elevated privileges. They revel in augmented limits for fee-free ATM withdrawals and international transfers, accompanied by overseas medical insurance, as well as protection against delayed baggage and flight disruptions. Additionally, they gain entry into the realm of cryptocurrency features, adding a layer of financial diversification.

3. Metal: Ascending to the zenith of Revolut’s offerings, the Metal plan eclipses the Premium tier. It is the mantle of a financial virtuoso, encompassing all the premium benefits. To these, it adds even higher limits on withdrawals and transfers, a tempting cashback program on card purchases, the attraction of a concierge service, and the showpiece—a gorgeous metal card that serves as a physical representation of one’s financial prowess.

4. Business: Revolut extends its benevolent embrace to businesses, offering specialized accounts. These corporate accounts proffer a wealth of features tailored to the intricate needs of businesses, from multi-currency accounts to corporate cards and expense management tools, ensuring that the financial pulse of the business remains steady and vibrant.

Each of these plans reflects Revolut’s commitment to flexibility and value, allowing users to select the plan that aligns most harmoniously with their individual financial needs. Whether one seeks the frugality of occasional international spending or the full suite of amenities for frequent global traversing and robust financial engagement, Revolut unfurls a tapestry of choices.

Is Revoluta Bank?

Potential users frequently wonder if Revolut counts as a bank, and the answer is complicated. Revolut started as a financial technology business offering banking services. Since then, it has made great progress toward being recognized as a bank in several jurisdictions.

As such, Revolut functions within the same regulatory protections and guidelines in these areas that clients are used to associated with traditional banks. Deposit insurance plans are among the benefits that fall under this category because they adhere to EU directives and provide coverage up to a predefined limit.

However, it is important to understand that Revolut’s banking services and its legal status as a bank can vary from nation to nation. Revolut maintains its financial technology and e-money institution designations while conducting business in areas where it lacks a banking license. In these situations, Revolut collaborates with authorized banks to safely hold client funds.

This setup ensures that Revolut can furnish bank-like services on a global scale, encompassing functionalities such as currency exchange, international transfers, and budgeting tools. Nevertheless, it is worth noting that precise regulatory protections, such as deposit insurance, might not be universally applicable.

It is paramount to recognize that this differentiation does not diminish the security or functionality of Revolut’s offerings. The company implements robust security measures to safeguard user accounts and transactions, irrespective of its banking status in a given region. This means that users can confidently enjoy the innovative features and convenience of Revolut while remaining attentive to the specific terms and protections available in their respective countries.

How much does Revolut cost?

Comprehending Revolut’s pricing structure is imperative for users seeking to maximize benefits at the most economical cost. Revolut places a high value on transparency and offers a variety of plans to accommodate various lifestyles and budgetary needs. There are specific features and associated costs associated with each plan. Revolut’s pricing strategy is essentially intended to offer consumers flexibility and value, letting them select a plan that easily meets their banking and money management requirements.

Fundamental to Revolut’s services is the Standard account, which is the lowest tier available and is free of charge. This account provides access to a host of essential app features, including the capability to hold and exchange multiple currencies, instantaneous spending notifications, and robust budgeting tools. The Standard plan is ideally suited for users whose financial needs revolve around basic services, with no requirement for extensive international spending or elevated transaction thresholds.

For those with more comprehensive financial demands, Revolut extends Premium and Metal plans, each associated with a monthly subscription fee. These premium plans confer additional benefits, including augmented limits on fee-free international ATM withdrawals, overseas medical insurance coverage, and access to exclusive offers and privileges, such as airport lounge access. The Metal plan, representing the pinnacle of premium offerings, incorporates additional perks such as cashback on spending and a distinctive, enduring metal card, among others.

Furthermore, it is imperative to note that Revolut applies specific fees for particular transactions across all account types. Such fees encompass charges for international transfers exceeding the plan’s limit, ATM withdrawals exceeding the free allocation, and currency exchange that surpasses the monthly no-fee threshold. Revolut meticulously delineates these fees within its fee schedule, thereby empowering users with the information necessary to make informed decisions regarding their transactions and mitigating the risk of unexpected charges.

Can You Use Revolut Aboard?

Indeed, Revolut is meticulously designed to cater to the needs of a global audience, rendering it an exceptional tool for international travelers and individuals engaged in transactions across multiple currencies. Users reap the advantages of real-time currency exchange at interbank rates, thereby facilitating cost-effective spending and withdrawals in local currencies, all devoid of exorbitant conversion fees.

Revolut’s card serves as an instrument for fee-free global spending and ATM withdrawals, contingent on the limits stipulated by the user’s selected plan. Location-based security protocols and the ability to rapidly freeze and unfreeze the card are just two of the robust security features included in the app to give travelers peace of mind when they travel.

Users must, however, make sure to carry out their due diligence and ascertain whether Revolut’s services are subject to any national restrictions or limitations prior to departing the nation. By staying informed about such factors, users can maximize the utility of Revolut’s features while navigating the intricacies of transactions in diverse geographic regions.

Revolut Customer Reviews

Revolut generally receives positive reviews for its innovative features, user-friendly interface, and the financial flexibility it offers, especially for international transactions and currency management. Users appreciate the ease of managing multiple currencies, setting budgets, and the instant notifications that help monitor spending.

However, some users have reported challenges with customer service and account freezes, which highlight areas for potential improvement by Revolut. These mixed reviews underscore the importance of considering individual needs and preferences when choosing a digital banking platform, as experiences can vary widely among users.

Alternatives To Revolut

Exploring alternatives to Revolut is a prudent step for those in pursuit of the perfect digital banking experience, finely tuned to their unique needs. While Revolut unfurls a comprehensive tapestry of services tailored for global spending, budgetary command, and currency exchange, several other platforms beckon with their own distinctive offerings. Here’s a captivating panorama of noteworthy alternatives to Revolut:

1. Wise (formerly TransferWise): Wise stands as a luminary in the realm of transparent financial operations. It is revered for its lucid fee structure and the real exchange rate it extends for currency conversions and international transfers. Wise is the harbinger of choice for individuals and businesses seeking cost-effective avenues to transmit funds overseas. In contrast to Revolut, Wise’s focus leans heavily towards currency exchange and international transfers, and it distinguishes itself with a detailed upfront cost breakdown.

2. N26: As an accredited banking institution, N26 orchestrates a symphony of banking services that encompass savings accounts, loans, and investment instruments, alongside its fundamental checking accounts and card services. The N26 app, bedecked in user-friendly attire, and its complimentary basic account make it a formidable contender. It beckons to those within the Eurozone and select markets, offering a fusion of traditional banking conventions infused with modern-day conveniences.

3. Monzo: Hailing from the United Kingdom, Monzo unfurls a banking experience adorned with a tapestry of features. It boasts budgeting tools, instantaneous notifications, and savings receptacles. Monzo reigns supreme in the UK, celebrated for its customer-centric ethos and community-driven spirit. Its all-encompassing approach to banking app development attracts those who prefer to steward all their financial activities under one digital roof.

4. Starling Bank: Another British entrant, Starling Bank, ascends to the financial stage, offering a comprehensive suite of banking services that spans personal, business, and joint accounts. It garners acclaim for its sterling customer service, enticing interest rates on savings, and a trove of innovative banking features. Starling Bank’s seamless amalgamation of banking services positions it as a beacon for users in search of a holistic banking solution.

5. PayPal: While not a bona fide banking institution, PayPal has a wide financial net. It offers a gamut of services, including online payments, fund transfers, and debit card issuance. Its global presence and ubiquity make it a convenient choice for online shopping and international transactions. However, PayPal’s fee structure for currency conversions and transfers may sway towards the higher end in comparison to other fintech alternatives.

Each of these alternatives to Revolut possesses its own unique strengths and appeals to a specific audience. It hinges upon the user’s distinctive financial inclinations, whether it be a preference for economical international transfers, a full banking spectrum, or a focus on digital transactions and online shopping.

FAQs: Revolut Review

Que: How do I add money to my Revolut account?

Ans: You can use bank transfers, credit or debit cards, or money received from other Revolut users to fund your account with Revolut.

Que: Are there any countries where Revolut cannot be used?

Ans: Although Revolut is accessible in many nations across the world, there are limitations in certain areas because of operational or regulatory constraints.

Que: Does Revolut offer interest on deposits?

Ans: In some areas, Revolut provides savings vaults with the potential to earn interest on the money saved.

Que: Can I manage cryptocurrencies with Revolut?

Ans: Certainly, Revolut’s app allows users to buy, store, and sell a range of cryptocurrencies via its cryptocurrency exchange services.

Que: How can I contact Revolut customer support?

Ans: Revolut provides customer support through in-app chat. Premium and Metal plan subscribers have access to priority support, which promises faster response times.

Summing Up: Revolut Review

Revolut stands out as a pioneering solution in the digital banking and fintech sectors, particularly for those with an international outlook on life and finance. Many find it to be an appealing option because of its smooth handling of multiple currencies and extensive feature set intended for international use, such as budgeting tools, instant money transfers, and security measures. The digital-first strategy, however, might not be appropriate for everyone, particularly for those who need more individualized customer care or prefer the security of traditional banking infrastructure.